Are you a homeowner in New Jersey and have been awarded either Social Security Disability benefits or Supplemental Security Income? If so, you may qualify for a special $250 annual tax deduction.

In order to receive the deduction you must show proof that you meet the requirements under New Jersey law.

In addition, you may also qualify for property tax reimbursement. This is essentially a property tax freeze.

If you are not a New Jersey resident you should review your home state's tax website or consult a tax lawyer or accountant in your area who is familiar with local state tax regulations.

Related post: Do I Have To Pay Taxes On Social Security Disability Benefits?

Monday, January 30, 2012

Disabled New Jersey Homeowners May Be Eligible For Tax Deduction & Property Tax Freeze

Monday, January 23, 2012

Can A Lawyer Help Me File For Supplemental Security Income (SSI)?

Yes, an attorney can assist you with your application for Supplemental Security Income (SSI). However, unlike when applying for SSD, the attorney cannot do your initial application online.

The reason why Social Security does not allow applicants to file their SSI application online is because before they review your disabilities and analyze your case from a disability standpoint, they determine whether you meet their financial criteria.

For this reason, most attorneys will require that if you are not eligible for SSD, that you apply for SSI on your own before they begin working on your case for you. The reason being, if you do not meet the criteria financially for SSI, there is nothing that your lawyer can do for you. You hire an attorney to assist you in proving to Social Security that you are disabled. If you do not meet the financial component, then Social Security never actually analyzes your case from a medical point of view.

If you intend on filing for Social Security disability benefits then I recommend you contact a lawyer in your area that is experienced in handling Social Security cases. They will inform you what their policy is on assisting with SSI applications if that is what you are applying for.

The reason why Social Security does not allow applicants to file their SSI application online is because before they review your disabilities and analyze your case from a disability standpoint, they determine whether you meet their financial criteria.

For this reason, most attorneys will require that if you are not eligible for SSD, that you apply for SSI on your own before they begin working on your case for you. The reason being, if you do not meet the criteria financially for SSI, there is nothing that your lawyer can do for you. You hire an attorney to assist you in proving to Social Security that you are disabled. If you do not meet the financial component, then Social Security never actually analyzes your case from a medical point of view.

If you intend on filing for Social Security disability benefits then I recommend you contact a lawyer in your area that is experienced in handling Social Security cases. They will inform you what their policy is on assisting with SSI applications if that is what you are applying for.

Friday, January 20, 2012

My Doctor Is Not Willing To Cooperate With Social Security or My Lawyer, What Should I Do?

Medical records are a crucial component of any Social Security Disability benefits (SSD) or Supplemental Security Income (SSI) case.

Unfortunately from time to time I have a client that tells me that either their doctor is unwilling to fill out paperwork stating that they are disabled or the doctor is unwilling to assist them in anyway. This isn't usually a deal breaker. Most of the time, if you've been treating with a doctor, then that doctor will have medical records for you. Those records include office visit notes, blood work results and any number of other test results that were forwarded back to that doctor's office.

As long as the doctor is willing to turn over those records then there should be no issue. If the doctor is not even willing to give you access to your records then it is critical to get your attorney involved. If it has reached this stage, then I strongly suggest beginning the process of looking elsewhere for a new treating physican.

This is not something that I like to advise and it should be a last resort. However, applying for Social Security can be a stressful process and more often than not a difficult process. There is no reason why you should have to stress out even more or make the process even more difficult. If you have a medical condition(s), either physical or mental that truly prevents you from working, then there are plenty of other doctors in your area who will treat you and are willing to assist you by providing the records needed to help prove to Social Security that you are in fact disabled.

Obviously, as an attorney, it is always much more helpful if a doctor is willing to complete forms that I send to him or her to complete. But, this isn't always necessary and often even if a doctor isn't willing to fill out additional forms as long as they are willing to provide your medical records this will not be an issue.

At some point at the beginning of the process, or preferably, before you have even applied for Social Security disability, you should discuss with your doctor your plans to apply for disability. Often this conversation will give you a better understanding how your doctor truly feels about your condition(s). If the doctor seems on board with you applying for Social Security disability then he or she is likely to be more cooperative when Social Security or your attorney requests information about your medical condition. If the doctor seems skeptical about the process then this could be a hint that in the future that particular doctor may not be of much assistance to your application for disability.

The truth of the matter is, many doctors have no idea what the criteria for Social Security disability is and some are much more reluctant than others to assist you through the process.

Unfortunately from time to time I have a client that tells me that either their doctor is unwilling to fill out paperwork stating that they are disabled or the doctor is unwilling to assist them in anyway. This isn't usually a deal breaker. Most of the time, if you've been treating with a doctor, then that doctor will have medical records for you. Those records include office visit notes, blood work results and any number of other test results that were forwarded back to that doctor's office.

As long as the doctor is willing to turn over those records then there should be no issue. If the doctor is not even willing to give you access to your records then it is critical to get your attorney involved. If it has reached this stage, then I strongly suggest beginning the process of looking elsewhere for a new treating physican.

This is not something that I like to advise and it should be a last resort. However, applying for Social Security can be a stressful process and more often than not a difficult process. There is no reason why you should have to stress out even more or make the process even more difficult. If you have a medical condition(s), either physical or mental that truly prevents you from working, then there are plenty of other doctors in your area who will treat you and are willing to assist you by providing the records needed to help prove to Social Security that you are in fact disabled.

Obviously, as an attorney, it is always much more helpful if a doctor is willing to complete forms that I send to him or her to complete. But, this isn't always necessary and often even if a doctor isn't willing to fill out additional forms as long as they are willing to provide your medical records this will not be an issue.

At some point at the beginning of the process, or preferably, before you have even applied for Social Security disability, you should discuss with your doctor your plans to apply for disability. Often this conversation will give you a better understanding how your doctor truly feels about your condition(s). If the doctor seems on board with you applying for Social Security disability then he or she is likely to be more cooperative when Social Security or your attorney requests information about your medical condition. If the doctor seems skeptical about the process then this could be a hint that in the future that particular doctor may not be of much assistance to your application for disability.

The truth of the matter is, many doctors have no idea what the criteria for Social Security disability is and some are much more reluctant than others to assist you through the process.

Thursday, January 19, 2012

I Receive A Social Security Check, Why Must I Sign Up For Direct Deposit?

Truthfully, you do not have to sign up for direct deposit. But, you also will not have the option of receiving a paper check beyond March 1, 2013. If you do not want to set up direct deposit then you can elect to receive your monthly Social Security benefits via the Direct Express prepaid debit card.

Social Security is moving to an entirely electronic payment system because they claim it will save them $1 billion over the next ten years. According to the Social Security Administration, it costs 92 cents more to issue a payment by paper check then it does by direct deposit.

Read more about the change in the Senior Journal.

Social Security is moving to an entirely electronic payment system because they claim it will save them $1 billion over the next ten years. According to the Social Security Administration, it costs 92 cents more to issue a payment by paper check then it does by direct deposit.

Read more about the change in the Senior Journal.

Tuesday, January 17, 2012

I Worked On The Books, Why Does Social Security Say I Don't Have Enough Work History Credits?

As you probably know, in order to qualify for Social Security Disability benefits (SSD), you need to have enough work history credits. If you do not have the work history credits, then it is possible you could still qualify for SSI or still qualify for SSD if you can prove that you were disabled prior to your date last insured.

Unfortunately, not everyone pays into Social Security while they are working. Sadly, this is not even something that you may have realized while you were working. Most people assume that if someone hasn't paid into Social Security that means they were working off the books or not paying taxes. But, there are certain jobs, where the employee pays taxes but they do not pay into Social Security.

It's becoming less frequent, but there are still jobs, mainly within the federal or local government that have their own pension plans that have decided not to require their employees to pay into Social Security. According to the National Association of Government Defined Contribution Administrators, about 30% of government workers do not pay into the Social Security system. Unfortunately those workers who have not paid into the system may end up not having enough work history credits when they retire or if they intend to file for disability benefits.

In dealing first hand with New Jersey public employees, I know that it is not even a generalization that can be made across the board for all of the public employees of one state. There are certain divisions or job titles within each of New Jersey's major government pension systems; Public Employees' Retirement System (PERS), Teachers' Pension and Annuity Fund (TPAF) and Police and Firemen's Retirement System (PRFS), that do and don't pay into Social Security.

Of course, even if you have a government job that does not withhold Social Security taxes from your paycheck, it is possible to qualify for SSD or retirement benefits if you have acquired enough work history credits from a previous job or a part-time job that you have.

If you are unsure whether or not you have enough work history credits then you should contact your local Social Security office.

Related post: Do I Have To Pay Taxes On Social Security Disability Benefits?

Unfortunately, not everyone pays into Social Security while they are working. Sadly, this is not even something that you may have realized while you were working. Most people assume that if someone hasn't paid into Social Security that means they were working off the books or not paying taxes. But, there are certain jobs, where the employee pays taxes but they do not pay into Social Security.

It's becoming less frequent, but there are still jobs, mainly within the federal or local government that have their own pension plans that have decided not to require their employees to pay into Social Security. According to the National Association of Government Defined Contribution Administrators, about 30% of government workers do not pay into the Social Security system. Unfortunately those workers who have not paid into the system may end up not having enough work history credits when they retire or if they intend to file for disability benefits.

In dealing first hand with New Jersey public employees, I know that it is not even a generalization that can be made across the board for all of the public employees of one state. There are certain divisions or job titles within each of New Jersey's major government pension systems; Public Employees' Retirement System (PERS), Teachers' Pension and Annuity Fund (TPAF) and Police and Firemen's Retirement System (PRFS), that do and don't pay into Social Security.

Of course, even if you have a government job that does not withhold Social Security taxes from your paycheck, it is possible to qualify for SSD or retirement benefits if you have acquired enough work history credits from a previous job or a part-time job that you have.

If you are unsure whether or not you have enough work history credits then you should contact your local Social Security office.

Related post: Do I Have To Pay Taxes On Social Security Disability Benefits?

Monday, January 16, 2012

Montclair, NJ Social Security Office Closing

According to The Bergen Record:

As part of its belt-tightening, the U.S. Social Security Administration will be closing its walk-in office on Bloomfield Avenue, consolidating that facility with its office in Clifton, officials said Friday.

The closing of the 7,100-square-foot facility will take place in early March, Shallman said. At that point, employees and operations from Montclair will be shifted to the Social Security office at 935 Allwood Road, Clifton, which is within five miles of the Montclair facility.

Sunday, January 15, 2012

Can I Receive SSI If I Leave The United States?

Under Federal Regulations

You lose your eligibility for SSI benefits for any month during all of which you are outside of the United States. If you are outside of the United States for 30 days or more in a row, you are not considered to be back in the United States until you are back for 30 days in a row.

You may again be eligible for SSI benefits in the month in which the 30 days end if you continue to meet all other eligibility requirements.

By United States, we mean the 50 States, the District of Columbia, and the Northern Mariana Islands.

Can I Receive SSI If I Leave The United States?

Under Federal Regulations

You lose your eligibility for SSI benefits for any month during all of which you are outside of the United States. If you are outside of the United States for 30 days or more in a row, you are not considered to be back in the United States until you are back for 30 days in a row.

You may again be eligible for SSI benefits in the month in which the 30 days end if you continue to meet all other eligibility requirements.

By United States, we mean the 50 States, the District of Columbia, and the Northern Mariana Islands.

Saturday, January 14, 2012

What Is The Five Step Sequential Evaluation Process?

In order to meet the required definition of disability under the law, an applicant "must have a severe impairment(s) that makes you unable to do your past relevant work or any other substantial gainful work that exists in the national economy."

If you do not have an impairment that meets one of Social Security's listings, then Social Security will analyze your Residual Functional Capacity under the five-step sequential evaluation process.

The five-step sequential evaluation process is a series of steps that Social Security uses to analyze your condition to determine whether or not you are disabled.

According to Social Security, "if we can find that you are disabled or not disabled at a step, we make our determination or decision and we do not go on to the next step. If we cannot find that you are disabled or not disabled at a step, we go on to the next step."

1. Are you working?

This is usually fairly straight forward, if you are engaged in substantial gainful activity then Social Security determines you to be working.

2. Is your medical condition "severe"?

Your disabilities must interfere with basic work related activities. Additionally, your disabilities must meet the Social Security duration requirement. This means "unless your impairment is expected to result in death, it must have lasted or must be expected to last for a continuous period of at least 12 months."

3. Does your disability meet a listing?

If your condition meets one of Social Security's listings or your condition is of equal severity to one of the listings then you will be found to be disabled.

4. Can you do past relevant work?

Social Security looks at the work that you did over the past 15 years to determine whether or not you can still do that work. If Social Security determines that you can still do this past work, then you will be found to be not disabled. If Social Security determines that due to physical or mental impairments that you cannot do your past relevant work, then they will proceed to the final step in deciding whether you are disabled.

5. Can you do any type of work?

If Social Security determines at Step 4 that you can no longer do your past relevant work, then they will look at whether you can adjust to another type of work. Social Security will consider your medical impairments (if any), physical condition along with your age, education, past work experience and any transferable job skills that you may have.

If Social Security determines that you can make an adjustment to another type of work then they will find that you are not disabled. However, if Social Security determines that you can't adjust to another type of work you will be found to be disabled.

According to the Regulations, if Social Security finds that you are capable of adjusting and doing other work, they are "responsible for providing evidence that demonstrates that other work exists in significant numbers in the national economy."

If you do not have an impairment that meets one of Social Security's listings, then Social Security will analyze your Residual Functional Capacity under the five-step sequential evaluation process.

The five-step sequential evaluation process is a series of steps that Social Security uses to analyze your condition to determine whether or not you are disabled.

According to Social Security, "if we can find that you are disabled or not disabled at a step, we make our determination or decision and we do not go on to the next step. If we cannot find that you are disabled or not disabled at a step, we go on to the next step."

1. Are you working?

This is usually fairly straight forward, if you are engaged in substantial gainful activity then Social Security determines you to be working.

2. Is your medical condition "severe"?

Your disabilities must interfere with basic work related activities. Additionally, your disabilities must meet the Social Security duration requirement. This means "unless your impairment is expected to result in death, it must have lasted or must be expected to last for a continuous period of at least 12 months."

3. Does your disability meet a listing?

If your condition meets one of Social Security's listings or your condition is of equal severity to one of the listings then you will be found to be disabled.

4. Can you do past relevant work?

Social Security looks at the work that you did over the past 15 years to determine whether or not you can still do that work. If Social Security determines that you can still do this past work, then you will be found to be not disabled. If Social Security determines that due to physical or mental impairments that you cannot do your past relevant work, then they will proceed to the final step in deciding whether you are disabled.

5. Can you do any type of work?

If Social Security determines at Step 4 that you can no longer do your past relevant work, then they will look at whether you can adjust to another type of work. Social Security will consider your medical impairments (if any), physical condition along with your age, education, past work experience and any transferable job skills that you may have.

If Social Security determines that you can make an adjustment to another type of work then they will find that you are not disabled. However, if Social Security determines that you can't adjust to another type of work you will be found to be disabled.

According to the Regulations, if Social Security finds that you are capable of adjusting and doing other work, they are "responsible for providing evidence that demonstrates that other work exists in significant numbers in the national economy."

What Is The Five Step Sequential Evaluation Process?

In order to meet the required definition of disability under the law, an applicant "must have a severe impairment(s) that makes you unable to do your past relevant work or any other substantial gainful work that exists in the national economy."

If you do not have an impairment that meets one of Social Security's listings, then Social Security will analyze your Residual Functional Capacity under the five-step sequential evaluation process.

The five-step sequential evaluation process is a series of steps that Social Security uses to analyze your condition to determine whether or not you are disabled.

According to Social Security, "if we can find that you are disabled or not disabled at a step, we make our determination or decision and we do not go on to the next step. If we cannot find that you are disabled or not disabled at a step, we go on to the next step."

1. Are you working?

This is usually fairly straight forward, if you are engaged in substantial gainful activity then Social Security determines you to be working.

2. Is your medical condition "severe"?

Your disabilities must interfere with basic work related activities. Additionally, your disabilities must meet the Social Security duration requirement. This means "unless your impairment is expected to result in death, it must have lasted or must be expected to last for a continuous period of at least 12 months."

3. Does your disability meet a listing?

If your condition meets one of Social Security's listings or your condition is of equal severity to one of the listings then you will be found to be disabled.

4. Can you do past relevant work?

Social Security looks at the work that you did over the past 15 years to determine whether or not you can still do that work. If Social Security determines that you can still do this past work, then you will be found to be not disabled. If Social Security determines that due to physical or mental impairments that you cannot do your past relevant work, then they will proceed to the final step in deciding whether you are disabled.

5. Can you do any type of work?

If Social Security determines at Step 4 that you can no longer do your past relevant work, then they will look at whether you can adjust to another type of work. Social Security will consider your medical impairments (if any), physical condition along with your age, education, past work experience and any transferable job skills that you may have.

If Social Security determines that you can make an adjustment to another type of work then they will find that you are not disabled. However, if Social Security determines that you can't adjust to another type of work you will be found to be disabled.

According to the Regulations, if Social Security finds that you are capable of adjusting and doing other work, they are "responsible for providing evidence that demonstrates that other work exists in significant numbers in the national economy."

If you do not have an impairment that meets one of Social Security's listings, then Social Security will analyze your Residual Functional Capacity under the five-step sequential evaluation process.

The five-step sequential evaluation process is a series of steps that Social Security uses to analyze your condition to determine whether or not you are disabled.

According to Social Security, "if we can find that you are disabled or not disabled at a step, we make our determination or decision and we do not go on to the next step. If we cannot find that you are disabled or not disabled at a step, we go on to the next step."

1. Are you working?

This is usually fairly straight forward, if you are engaged in substantial gainful activity then Social Security determines you to be working.

2. Is your medical condition "severe"?

Your disabilities must interfere with basic work related activities. Additionally, your disabilities must meet the Social Security duration requirement. This means "unless your impairment is expected to result in death, it must have lasted or must be expected to last for a continuous period of at least 12 months."

3. Does your disability meet a listing?

If your condition meets one of Social Security's listings or your condition is of equal severity to one of the listings then you will be found to be disabled.

4. Can you do past relevant work?

Social Security looks at the work that you did over the past 15 years to determine whether or not you can still do that work. If Social Security determines that you can still do this past work, then you will be found to be not disabled. If Social Security determines that due to physical or mental impairments that you cannot do your past relevant work, then they will proceed to the final step in deciding whether you are disabled.

5. Can you do any type of work?

If Social Security determines at Step 4 that you can no longer do your past relevant work, then they will look at whether you can adjust to another type of work. Social Security will consider your medical impairments (if any), physical condition along with your age, education, past work experience and any transferable job skills that you may have.

If Social Security determines that you can make an adjustment to another type of work then they will find that you are not disabled. However, if Social Security determines that you can't adjust to another type of work you will be found to be disabled.

According to the Regulations, if Social Security finds that you are capable of adjusting and doing other work, they are "responsible for providing evidence that demonstrates that other work exists in significant numbers in the national economy."

Friday, January 13, 2012

What Is Social Security's Definition Of Disability?

The Code of Federal Regulations defines what disability means in §404.1505.

According the to the Regulations:

If you do not have an impairment that meets one of Social Security's listings, then Social Security will analyze your Residual Functional Capacity under the five-step sequential evaluation process.

The Social Security Administration has different rules for those who are blind.

Declan Gourley is a New Jersey Social Security Disability lawyer.

According the to the Regulations:

The law defines disability as the inability to do any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months.In order to meet the required definition of disability under the law, an applicant "must have a severe impairment(s) that makes you unable to do your past relevant work or any other substantial gainful work that exists in the national economy."

If you do not have an impairment that meets one of Social Security's listings, then Social Security will analyze your Residual Functional Capacity under the five-step sequential evaluation process.

The Social Security Administration has different rules for those who are blind.

Declan Gourley is a New Jersey Social Security Disability lawyer.

What Is Social Security's Definition Of Disability?

The Code of Federal Regulations defines what disability means in §404.1505.

According the to the Regulations:

If you do not have an impairment that meets one of Social Security's listings, then Social Security will analyze your Residual Functional Capacity under the five-step sequential evaluation process.

The Social Security Administration has different rules for those who are blind.

Declan Gourley is a New Jersey Social Security Disability lawyer.

According the to the Regulations:

The law defines disability as the inability to do any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months.In order to meet the required definition of disability under the law, an applicant "must have a severe impairment(s) that makes you unable to do your past relevant work or any other substantial gainful work that exists in the national economy."

If you do not have an impairment that meets one of Social Security's listings, then Social Security will analyze your Residual Functional Capacity under the five-step sequential evaluation process.

The Social Security Administration has different rules for those who are blind.

Declan Gourley is a New Jersey Social Security Disability lawyer.

Thursday, January 12, 2012

What Is Sheltered Work?

As we have already discussed, in order to determine if an individual is disabled Social Security will first look at whether or not that person can engage in Substantial Gainful Activity. However, there are special exceptions for when an individual can be found to be receiving more than SGA but still be found to be disabled.

A special exception to this rule is known as "sheltered work" or "special environment." Basically, this means that the individual is being offered a special opportunity by their employer that normally does not exist.

Recently I had a client who had very severe back injuries from a car accident awarded Social Security Disability Benefits even though he had been earning over SGA for the past year. The client had a friend, who operated a business and offered the disabled individual an opportunity to work for him. It was a commissioned position and he worked as an independent contractor. The employer had several different employees responsible for the same tasks however they were required to work a set schedule and work at least 40 hours per week. The employer knew that my client was disabled and was very flexible with him. The disabled individual was only able to work at most three hours per day and a few times per week it was common for him to call work and say he was in too much pain and couldn't come into work. The employer had no problem with the disabled worker going out to his car as needed to take naps when he became too fatigued to function.

Since the employer was his friend, he was giving him an opportunity that he would not have given to any other employee. The business owner completed a certification stating that he had given the individual the job only because he was his friend and that no other employee would be afforded the same flexibility. The individual knew that no other employer would hire him because of the flexibility that he required due to his disabilities. Although he was earning more than SGA most months, the only reason why he was able to keep a job was because of the special relationship he had with his employer.

The judge agreed that even though the applicant was involved in work where he was earning more than SGA, it was sheltered work.

It is usually not easy to show that work is sheltered, but an experienced Social Security attorney will know what questions to ask the employer, what documentation to get and how to present the argument to the judge at the Administrative Law Hearing.

A special exception to this rule is known as "sheltered work" or "special environment." Basically, this means that the individual is being offered a special opportunity by their employer that normally does not exist.

Recently I had a client who had very severe back injuries from a car accident awarded Social Security Disability Benefits even though he had been earning over SGA for the past year. The client had a friend, who operated a business and offered the disabled individual an opportunity to work for him. It was a commissioned position and he worked as an independent contractor. The employer had several different employees responsible for the same tasks however they were required to work a set schedule and work at least 40 hours per week. The employer knew that my client was disabled and was very flexible with him. The disabled individual was only able to work at most three hours per day and a few times per week it was common for him to call work and say he was in too much pain and couldn't come into work. The employer had no problem with the disabled worker going out to his car as needed to take naps when he became too fatigued to function.

Since the employer was his friend, he was giving him an opportunity that he would not have given to any other employee. The business owner completed a certification stating that he had given the individual the job only because he was his friend and that no other employee would be afforded the same flexibility. The individual knew that no other employer would hire him because of the flexibility that he required due to his disabilities. Although he was earning more than SGA most months, the only reason why he was able to keep a job was because of the special relationship he had with his employer.

The judge agreed that even though the applicant was involved in work where he was earning more than SGA, it was sheltered work.

It is usually not easy to show that work is sheltered, but an experienced Social Security attorney will know what questions to ask the employer, what documentation to get and how to present the argument to the judge at the Administrative Law Hearing.

I Received Mail From Social Security, What Should I Do?

Once you have applied for Social Security disability or SSI you will begin receiving mail from the Social Security Administration.

Sometimes these letters are just confirmation letters and require no response. But, often the letter will require a response from you in order to assist Social Security in making a decision on your case.

First, I will tell you what you should not do. You should not ignore the letter, throw it in the garbage or put it in a pile of papers to get to "later on."

You should make any correspondence from Social Security your number one priority throughout the entire process.

If you have an attorney then you should call them to let them know that you received a letter from Social Security and tell them what the content of the letter is. Often your attorney will have already received the same letter. Typically when Social Security has sent you a letter, they have also mailed the letter to your attorney. Unfortunately, this is not always the case. You cannot assume that just because you got the letter that your attorney also got it.

If you do not have an attorney then it is extremely important that you read the letter carefully. If you don't fully understand what the letter is either stating or requesting the first time, then read the letter multiple times. Often the letter will request you to respond within a certain time frame. It is very important that you adhere to these deadlines. Typically Social Security will set a time frame for responding. If you fail to respond within that time frame then they may make a decision on your case without the information that they are requesting. A standard time frame that Social Security often gives an applicant to respond is ten days.

If at any point you are confused or feel overwhelmed by Social Security's request then I suggest that you contact a lawyer with experience in assisting disabled individuals file for Social Security disability.

Sometimes these letters are just confirmation letters and require no response. But, often the letter will require a response from you in order to assist Social Security in making a decision on your case.

First, I will tell you what you should not do. You should not ignore the letter, throw it in the garbage or put it in a pile of papers to get to "later on."

You should make any correspondence from Social Security your number one priority throughout the entire process.

If you have an attorney then you should call them to let them know that you received a letter from Social Security and tell them what the content of the letter is. Often your attorney will have already received the same letter. Typically when Social Security has sent you a letter, they have also mailed the letter to your attorney. Unfortunately, this is not always the case. You cannot assume that just because you got the letter that your attorney also got it.

If you do not have an attorney then it is extremely important that you read the letter carefully. If you don't fully understand what the letter is either stating or requesting the first time, then read the letter multiple times. Often the letter will request you to respond within a certain time frame. It is very important that you adhere to these deadlines. Typically Social Security will set a time frame for responding. If you fail to respond within that time frame then they may make a decision on your case without the information that they are requesting. A standard time frame that Social Security often gives an applicant to respond is ten days.

If at any point you are confused or feel overwhelmed by Social Security's request then I suggest that you contact a lawyer with experience in assisting disabled individuals file for Social Security disability.

Wednesday, January 11, 2012

What Is A Common Mistake Claimants Make That Is Easily Fixed?

One of the most common mistakes that people applying for Social Security disability benefits make is being overly vague. No attorney or Administrative Law Judge expects you to be the next Stephen King, recalling everything in immaculate detail, but in my opinion this is one area where clients hurt themselves and it is very easily corrected if you realize the mistake and the problems that it can cause.

When I meet my client for the first time the interview is very detailed as I want to fully understand what the person's disabilities are, how their daily activities are restricted, how often they are affected by their conditions and basically get an overall understanding as to how this person is affected by their medical condition(s). The overwhelming majority of people answer questions very vaguely. For instance, I may ask a person how often they have difficulty sleeping at night. A common response to a question like this is "sometimes," "often" or "from time to time."

When they do this, I immediately get to work on changing the way that person answers those types of questions. You see, I know that if I really have no idea how often the problem(s) exist then I know that if the case were to go to hearing that there is no way an Administrative Law Judge will know either. You have to prove to the Social Security Administration that you are disabled and unable to work. I am not asking or even hinting that you should lie or exaggerate. But, there's a significant difference in saying "sometimes," and in saying "three times a week," or "five times a month."

The same applies when you complete the initial application to apply for Social Security disability or the forms that Social Security requests that you complete such as the Work History Report or Adult Function Reports. If you answer questions vaguely on those forms then there is no way for a disability examiner to truly understand what limits your ability to work.

When speaking in frequency, you should always try to attach a number of occurrences that the event or problem happens in a day, week, month or year. What often happens is that because you have been living with this impairment or problem for a period of time you begin to get used to it and feel almost like others will understand. The problem is, the majority of time, others do not understand. The definition of "sometimes" to you may mean a few times a week, whereas to someone else it may mean once a month.

It is important to keep in mind when talking to anyone about your disabilities how it affects you and how often it does. Assume that the person (whether it be your attorney, a doctor or an Administrative Law Judge) who is asking you about your disability knows NOTHING about it, what the symptoms are and how often they affect you.

When I meet my client for the first time the interview is very detailed as I want to fully understand what the person's disabilities are, how their daily activities are restricted, how often they are affected by their conditions and basically get an overall understanding as to how this person is affected by their medical condition(s). The overwhelming majority of people answer questions very vaguely. For instance, I may ask a person how often they have difficulty sleeping at night. A common response to a question like this is "sometimes," "often" or "from time to time."

When they do this, I immediately get to work on changing the way that person answers those types of questions. You see, I know that if I really have no idea how often the problem(s) exist then I know that if the case were to go to hearing that there is no way an Administrative Law Judge will know either. You have to prove to the Social Security Administration that you are disabled and unable to work. I am not asking or even hinting that you should lie or exaggerate. But, there's a significant difference in saying "sometimes," and in saying "three times a week," or "five times a month."

The same applies when you complete the initial application to apply for Social Security disability or the forms that Social Security requests that you complete such as the Work History Report or Adult Function Reports. If you answer questions vaguely on those forms then there is no way for a disability examiner to truly understand what limits your ability to work.

When speaking in frequency, you should always try to attach a number of occurrences that the event or problem happens in a day, week, month or year. What often happens is that because you have been living with this impairment or problem for a period of time you begin to get used to it and feel almost like others will understand. The problem is, the majority of time, others do not understand. The definition of "sometimes" to you may mean a few times a week, whereas to someone else it may mean once a month.

It is important to keep in mind when talking to anyone about your disabilities how it affects you and how often it does. Assume that the person (whether it be your attorney, a doctor or an Administrative Law Judge) who is asking you about your disability knows NOTHING about it, what the symptoms are and how often they affect you.

Where Is My Local Social Security Office?

If you are trying to locate your local Social Security office then all you need to know is your five digit zip code.

If you know your zip code, then go to the office locator on the Social Security website and enter that information.

If you know your zip code, then go to the office locator on the Social Security website and enter that information.

Tuesday, January 10, 2012

I Was Recently Awarded Social Security Disability Benefits, What Day Do I Get Paid Each Month?

Social Security has a system in place to determine when you will be paid your Social Security disability benefits each month.

Social Security benefits are paid after the month that they are due. Basically, each month that you receive a check from Social Security, that money is for the month preceding the check. If you receive your check at the end of February, that is your monthly benefits for January.

According to Social Security, if you receive benefits as:

If the birthday falls on the 11th - 20th of the month then your benefits are paid on the Third Wednesday of the month.

If the birthday falls on the 21st - 31st of the month then your benefits are paid on the Fourth Wednesday of the month.

Social Security benefits are paid after the month that they are due. Basically, each month that you receive a check from Social Security, that money is for the month preceding the check. If you receive your check at the end of February, that is your monthly benefits for January.

According to Social Security, if you receive benefits as:

- A retired or disabled worker, the payment day will be determined by your birth date.

- A spouse, the payment day will be determined by your spouse's birth date.

- A survivor, the payment day will be determined by your parent's/spouse's birth date.

- A retired or disabled worker and as a spouse, the payment day will be determined by the birth date of the beneficiary of the benefit first received.

If the birthday falls on the 11th - 20th of the month then your benefits are paid on the Third Wednesday of the month.

If the birthday falls on the 21st - 31st of the month then your benefits are paid on the Fourth Wednesday of the month.

Monday, January 9, 2012

What Is A Common Mistake Claimants Make That Is Easily Fixed?

One of the most common mistakes that people applying for Social Security disability benefits make is being overly vague. No attorney or Administrative Law Judge expects you to be the next Stephen King, recalling everything in immaculate detail, but in my opinion this is one area where clients hurt themselves and it is very easily corrected if you realize the mistake and the problems that it can cause.

When I meet my client for the first time the interview is very detailed as I want to fully understand what the person's disabilities are, how their daily activities are restricted, how often they are affected by their conditions and basically get an overall understanding as to how this person is affected by their medical condition(s). The overwhelming majority of people answer questions very vaguely. For instance, I may ask a person how often they have difficulty sleeping at night. A common response to a question like this is "sometimes," "often" or "from time to time."

When they do this, I immediately get to work on changing the way that person answers those types of questions. You see, I know that if I really have no idea how often the problem(s) exist then I know that if the case were to go to hearing that there is no way an Administrative Law Judge will know either. You have to prove to the Social Security Administration that you are disabled and unable to work. I am not asking or even hinting that you should lie or exaggerate. But, there's a significant difference in saying "sometimes," and in saying "three times a week," or "five times a month."

The same applies when you complete the initial application to apply for Social Security disability or the forms that Social Security requests that you complete such as the Work History Report or Adult Function Reports. If you answer questions vaguely on those forms then there is no way for a disability examiner to truly understand what limits your ability to work.

When speaking in frequency, you should always try to attach a number of occurrences that the event or problem happens in a day, week, month or year. What often happens is that because you have been living with this impairment or problem for a period of time you begin to get used to it and feel almost like others will understand. The problem is, the majority of time, others do not understand. The definition of "sometimes" to you may mean a few times a week, whereas to someone else it may mean once a month.

It is important to keep in mind when talking to anyone about your disabilities how it affects you and how often it does. Assume that the person (whether it be your attorney, a doctor or an Administrative Law Judge) who is asking you about your disability knows NOTHING about it, what the symptoms are and how often they affect you.

When I meet my client for the first time the interview is very detailed as I want to fully understand what the person's disabilities are, how their daily activities are restricted, how often they are affected by their conditions and basically get an overall understanding as to how this person is affected by their medical condition(s). The overwhelming majority of people answer questions very vaguely. For instance, I may ask a person how often they have difficulty sleeping at night. A common response to a question like this is "sometimes," "often" or "from time to time."

When they do this, I immediately get to work on changing the way that person answers those types of questions. You see, I know that if I really have no idea how often the problem(s) exist then I know that if the case were to go to hearing that there is no way an Administrative Law Judge will know either. You have to prove to the Social Security Administration that you are disabled and unable to work. I am not asking or even hinting that you should lie or exaggerate. But, there's a significant difference in saying "sometimes," and in saying "three times a week," or "five times a month."

The same applies when you complete the initial application to apply for Social Security disability or the forms that Social Security requests that you complete such as the Work History Report or Adult Function Reports. If you answer questions vaguely on those forms then there is no way for a disability examiner to truly understand what limits your ability to work.

When speaking in frequency, you should always try to attach a number of occurrences that the event or problem happens in a day, week, month or year. What often happens is that because you have been living with this impairment or problem for a period of time you begin to get used to it and feel almost like others will understand. The problem is, the majority of time, others do not understand. The definition of "sometimes" to you may mean a few times a week, whereas to someone else it may mean once a month.

It is important to keep in mind when talking to anyone about your disabilities how it affects you and how often it does. Assume that the person (whether it be your attorney, a doctor or an Administrative Law Judge) who is asking you about your disability knows NOTHING about it, what the symptoms are and how often they affect you.

Saturday, January 7, 2012

Social Security Sent Me A Direct Express Card, What Is It?

Social Security is in the process of making all payment processing electronic, they are eliminating the issuing of checks. As of May 2011 if you are awarded Social Security benefits (either SSD or SSI), you must receive your monthly benefit electronically.

Social Security has stated that "You must switch to electronic payments by March 1, 2013. If you don't, the U.S. Department of the Treasury may send your benefits via the Direct Express® card program to avoid an interruption in payment." We are quite some time away from 2013, but I have already had clients who have begun receiving the Direct Express card.

If you want to avoid receiving the Direct Express card then you should set up direct deposit through your bank account. Obviously this is an issue if you don't have a bank account.

According to Social Security:

Despite the convenience this Direct Express card seems to offer, I strongly recommend setting up Direct Deposit through a bank. Despite the advantages the card seems to offer, there are many surcharges associated with the card; to withdraw cash at an ATM, to transfer funds to a bank account, to replace lost cards, monthly paper statements and international usage.

For additional information, review the Frequently Asked Questions page on the Direct Express website.

Social Security has stated that "You must switch to electronic payments by March 1, 2013. If you don't, the U.S. Department of the Treasury may send your benefits via the Direct Express® card program to avoid an interruption in payment." We are quite some time away from 2013, but I have already had clients who have begun receiving the Direct Express card.

If you want to avoid receiving the Direct Express card then you should set up direct deposit through your bank account. Obviously this is an issue if you don't have a bank account.

According to Social Security:

The Direct Express card is a debit card you can use to access your benefits. And you don't need a bank account.Similar to a debit card that a bank issues customers, your Direct Express card has a PIN number. In order to use the card you will have to enter the PIN number, this prevents someone else from using your card if it is lost or stolen.

With the Direct Express card program, we deposit your federal benefit payment directly into your card account. Your monthly benefits will be available on your payment day—on time, every time. You can use the card to make purchases, pay bills or get cash at thousands of locations. And most transactions are free.

The Direct Express card is both safer and more convenient than paper checks. Anyone receiving Social Security or Supplemental Security Income payments can enroll. No more waiting for the mail or worrying about lost or stolen checks.

Despite the convenience this Direct Express card seems to offer, I strongly recommend setting up Direct Deposit through a bank. Despite the advantages the card seems to offer, there are many surcharges associated with the card; to withdraw cash at an ATM, to transfer funds to a bank account, to replace lost cards, monthly paper statements and international usage.

For additional information, review the Frequently Asked Questions page on the Direct Express website.

Friday, January 6, 2012

How Long Are Doctors Or Hospitals Required To Keep My Medical Records?

Clients commonly want to know how long a doctor or hospital is legally obligated to keep their medical records for. This is especially important in "Date Last Insured" cases, when the person may not have seen a particular doctor who has relevant medical records in quite some time.

The law varies by state, so depending on where your doctor's office or the hospital is located, there may be a different length of time that source is required by law to keep the records.

In New Jersey according to Consumer Affairs:

Since medical records are crucial when applying for Social Security Disability, it is my recommendation to routinely ask doctors or hospitals for a copy of your medical records. It is not always easy to distinguish "important" medical records from the irrelevant records, so if at all possible, you should keep copies of all medical records.

The law varies by state, so depending on where your doctor's office or the hospital is located, there may be a different length of time that source is required by law to keep the records.

In New Jersey according to Consumer Affairs:

A doctor has to keep a patient’s medical records for seven years. After that, the physician can destroy them. There is no requirement in the law that requires the physician to notify a patient prior to destroying the records. It is recommended that you request a copy of your medical records when you are changing physicians.Meanwhile, in New York:

Physicians must keep patient records for six years after the last visit. Records for children are kept for one year after the child's 18th birthday.In saying this, I would not assume just because it is beyond that amount of time that the records have been destroyed. In my experience, often hospitals are more likely to destroy records as soon as they are legally able to. Meanwhile, small doctor's offices are more likely to be less organized with their destruction of documents and may have medical records for several decades still in their filing cabinets.

Since medical records are crucial when applying for Social Security Disability, it is my recommendation to routinely ask doctors or hospitals for a copy of your medical records. It is not always easy to distinguish "important" medical records from the irrelevant records, so if at all possible, you should keep copies of all medical records.

Labels:

Date Last Insured,

FAQs,

Medical Records

Thursday, January 5, 2012

Payroll Tax Cuts Not Good For People With Disabilities

You may have recently heard about the payroll tax cuts that were extended for an additional two months by Congress. Many Americans, especially the lower and middle class, have viewed this as a good thing. Anytime less money is taken out of your pay check it's got to be a good thing, right?

Not necessarily, unfortunately. You see the problem is that the tax cut comes at the cost of not adding funds into the Social Security Trust Fund. Typically, 6.2% of your salary is taxed and added to the Social Security Trust Fund. Additionally, your employer contributes 6.2% of your salary to the same fund. In 2011, many Americans were pleased when it was announced that their contribution would be reduced to 4.2%. Multiply that 2% deduction being paid into the Social Security Trust Fund by every working American's contribution and that's a huge chunk of change (estimated to cost over $33 billion).

Money was taken from the United States general revenue to offset the reduction of money being contributed into the Social Security Trust Fund. But, there is no guarantee that Congress will continue to allow that deficit to be made up by just taking funds from the general revenue or charging fees to banks and mortgage companies and placing it into Social Security. Instead of the Social Security program depending on itself to fund retirement and disability benefits, the program now relies on Congress to direct funds from other places into the Social Security Trust Fund.

This may not seem like a huge problem now. But, there is no doubt the Social Security program is currently under attack by many politicians.

The overwhelming majority of Americans live pay check to pay check and the only income they expect to have when they retire will be their Social Security check. If Social Security disappears, or the funds available are greatly reduced, where will retirees or disabled individuals turn for financial assistance?

Read more about the problems this poses for disabled individuals here.

Not necessarily, unfortunately. You see the problem is that the tax cut comes at the cost of not adding funds into the Social Security Trust Fund. Typically, 6.2% of your salary is taxed and added to the Social Security Trust Fund. Additionally, your employer contributes 6.2% of your salary to the same fund. In 2011, many Americans were pleased when it was announced that their contribution would be reduced to 4.2%. Multiply that 2% deduction being paid into the Social Security Trust Fund by every working American's contribution and that's a huge chunk of change (estimated to cost over $33 billion).

Money was taken from the United States general revenue to offset the reduction of money being contributed into the Social Security Trust Fund. But, there is no guarantee that Congress will continue to allow that deficit to be made up by just taking funds from the general revenue or charging fees to banks and mortgage companies and placing it into Social Security. Instead of the Social Security program depending on itself to fund retirement and disability benefits, the program now relies on Congress to direct funds from other places into the Social Security Trust Fund.

This may not seem like a huge problem now. But, there is no doubt the Social Security program is currently under attack by many politicians.

The overwhelming majority of Americans live pay check to pay check and the only income they expect to have when they retire will be their Social Security check. If Social Security disappears, or the funds available are greatly reduced, where will retirees or disabled individuals turn for financial assistance?

Read more about the problems this poses for disabled individuals here.

American workers usually pay a tax of 6.2 percent on their earnings to build the Social Security Trust Fund.

Read more here: http://www.bellinghamherald.com/2011/12/28/2327482/why-the-payroll-tax-deal-is-bad.html#storylink=cpy

Read more here: http://www.bellinghamherald.com/2011/12/28/2327482/why-the-payroll-tax-deal-is-bad.html#storylink=cpy

American workers usually pay a tax of 6.2 percent on their earnings to build the Social Security Trust Fund.

Read more here: http://www.bellinghamherald.com/2011/12/28/2327482/why-the-payroll-tax-deal-is-bad.html#storylink=cpy

Read more here: http://www.bellinghamherald.com/2011/12/28/2327482/why-the-payroll-tax-deal-is-bad.html#storylink=cpy

Wednesday, January 4, 2012

What Is Reconsideration?

In most states if you want to appeal Social Security's decision to deny you disability benefits at the initial application you must "request reconsideration."

Several states, including New York, have eliminated this stage of the process. If you receive a denial notice from Social Security at the initial application then the letter from Social Security will inform you whether your next level of appeal is requesting reconsideration or, if you can request a hearing in front of an Administrative Law Judge.

In most states, including New Jersey, if you want to appeal Social Security's decision at the initial application, then you must request reconsideration. What does this mean? Basically, a different disability examiner employed by Social Security will review your case and determine whether or not you are disabled. Unfortunately, the overwhelming majority of the time, the result at Reconsideration is the same as the initial decision. Only about 20% of applicants are successful in getting approved for Social Security Disability benefits at the Reconsideration level.

If you have been denied Social Security benefits at the initial application and want to appeal that decision in most states you must file for reconsideration. It is important if you are not represented by an attorney that you read the letter from Social Security very carefully and submit the appeal within the required time frame. Social Security requires that if you are filing for reconsideration that your request must be returned within 65 days from the date on the denial letter. It is important to know that filing a new application is very different than filing an appeal.

Several states, including New York, have eliminated this stage of the process. If you receive a denial notice from Social Security at the initial application then the letter from Social Security will inform you whether your next level of appeal is requesting reconsideration or, if you can request a hearing in front of an Administrative Law Judge.

In most states, including New Jersey, if you want to appeal Social Security's decision at the initial application, then you must request reconsideration. What does this mean? Basically, a different disability examiner employed by Social Security will review your case and determine whether or not you are disabled. Unfortunately, the overwhelming majority of the time, the result at Reconsideration is the same as the initial decision. Only about 20% of applicants are successful in getting approved for Social Security Disability benefits at the Reconsideration level.

If you have been denied Social Security benefits at the initial application and want to appeal that decision in most states you must file for reconsideration. It is important if you are not represented by an attorney that you read the letter from Social Security very carefully and submit the appeal within the required time frame. Social Security requires that if you are filing for reconsideration that your request must be returned within 65 days from the date on the denial letter. It is important to know that filing a new application is very different than filing an appeal.

Tuesday, January 3, 2012

I Was Recently Awarded SSI, Do I Get Medicare or Medicaid?

When you receive Supplemental Security Income (SSI) you become eligible for Medicaid immediately.

If you are a low income individual, you can also apply for Medicaid regardless of whether or not Social Security has awarded you SSI benefits.

This means that if you have applied for SSI, you should also apply at your local Medicaid office for Medicaid, since it is possible to receive these medical benefits without waiting for a decision on your SSI application.

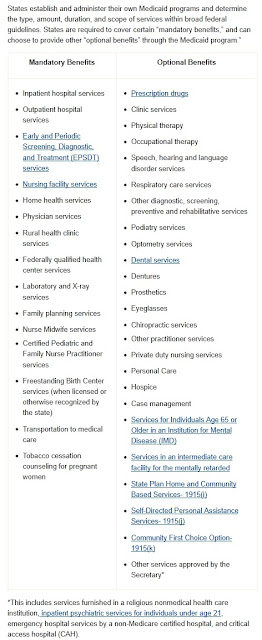

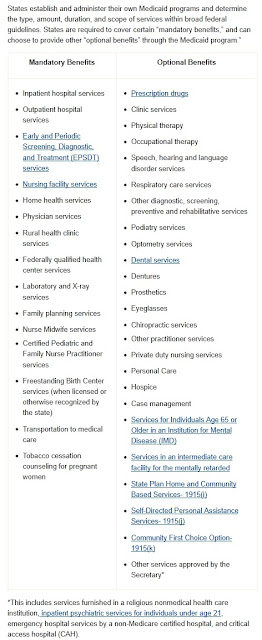

According to Medicaid.gov:

Note: If you have been awarded SSD then you will be eligible for Medicare.

If you are a low income individual, you can also apply for Medicaid regardless of whether or not Social Security has awarded you SSI benefits.

This means that if you have applied for SSI, you should also apply at your local Medicaid office for Medicaid, since it is possible to receive these medical benefits without waiting for a decision on your SSI application.

According to Medicaid.gov:

Medicaid coverage may start retroactively for up to 3 months prior to the month of application, if the individual would have been eligible during the retroactive period had he or she applied then.The benefits that you will receive through Medicaid varies by state. The list below is a full list of benefits that you may be eligible for, based on the state that you live in.

Note: If you have been awarded SSD then you will be eligible for Medicare.

Monday, January 2, 2012

I Was Recently Awarded SSD, When Do I Get Medicare?

When you receive Social Security Disability benefits (SSD) you automatically become eligible for Medicare two years from the date you become eligible for benefits.

For example, you receive your Notice of Award in June, 2011 with your onset date determined to be May, 2009. Due to the five month waiting period, you are eligible for benefits as of October, 2009. Under SSD rules you will automatically be eligible for Medicare two years from the date you first started receiving SSD benefits, you will be eligible for Medicare as of October, 2011.

To see what benefits are available through Medicare, check out Medicare.gov

Note: If you have been awarded SSI but you are not eligible for SSD then you will not receive Medicare, you will be eligible for Medicaid.

For example, you receive your Notice of Award in June, 2011 with your onset date determined to be May, 2009. Due to the five month waiting period, you are eligible for benefits as of October, 2009. Under SSD rules you will automatically be eligible for Medicare two years from the date you first started receiving SSD benefits, you will be eligible for Medicare as of October, 2011.

To see what benefits are available through Medicare, check out Medicare.gov

Note: If you have been awarded SSI but you are not eligible for SSD then you will not receive Medicare, you will be eligible for Medicaid.

Sunday, January 1, 2012

How Important Are Medical Records When Applying For Social Security Disability?

|

| Image Source |

Why? Well, aside from the fact that seeking medical treatment is a good way to improve your health or get a better understanding of your disabilities it is also critical evidence that can be very useful in proving to Social Security that you are in fact disabled.

When you initially apply for SSD or SSI, you are required to inform Social Security of any doctors, hospitals or clinics you have seen that will have medical records. Social Security also wants a list of all medications that you are currently taking and all tests (X-Rays, MRIs, CT Scans, etc.) that you have done pertaining to your disabilities.

If you are considering applying for SSD or SSI, or have already done so, it would be a good idea to keep track of all doctor and hospital visits. Make sure you document what tests you have done and have a general idea what disabilities you have and any medical conditions that you have been diagnosed with. It's always better to clearly indicate to Social Security what conditions/impairments prevent you from working, rather than assuming that someone at Social Security will read through pages and pages of medical records to understand what your problems are.

If you do not have health insurance or have limited finances you should contact Social Services in your area to see if you qualify for Medicaid or contact local hospitals/clinics to see if they have Charity Care programs. If you apply for Charity Care in one hospital or clinic and are told you do not qualify you should not give up, each individual facility has different size Charity Care programs and different criteria for qualifying.

I cannot stress enough how important a role medical records plays in determining whether a claimant will receive Social Security Disability benefits through the Social Security Administration.

Labels:

Charity Care,

FAQs,

Medical Records,

SSD,

SSI

Subscribe to:

Posts (Atom)